HERE’S THE LATEST ON THE ATLAS WATERFRONT PARK PROJECT

CHECK BACK SOON FOR MORE UPDATES

UPDATE AS OF DECEMBER 2021

UPDATE AS OF MAY 2021

With the Atlas Waterfront Project expanding, they now have put inplace a walking trail that you are able to stroll along the waters edge and expirence the beauty of Coeur d’Alene and see all of the new construction for yourself.

Atlas Driving Tour #2

Atlas Driving Tour #3

Atlas Driving Tour #4

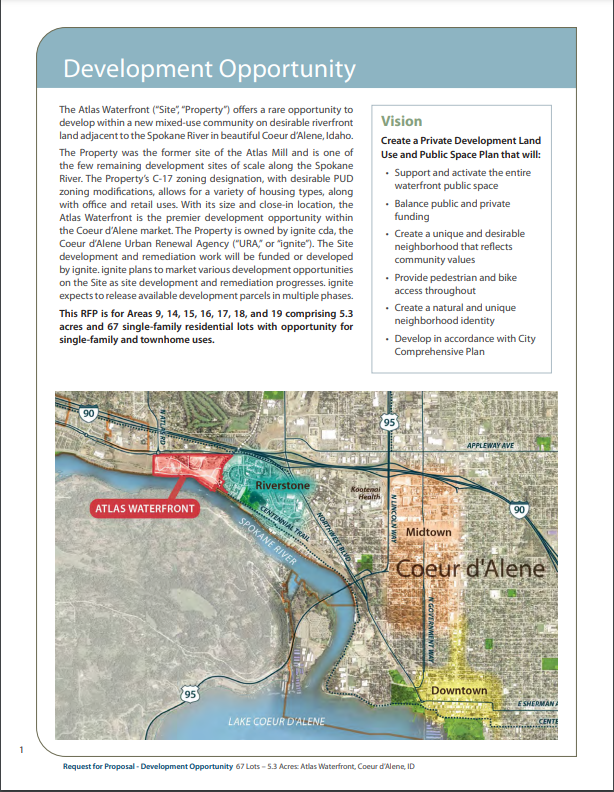

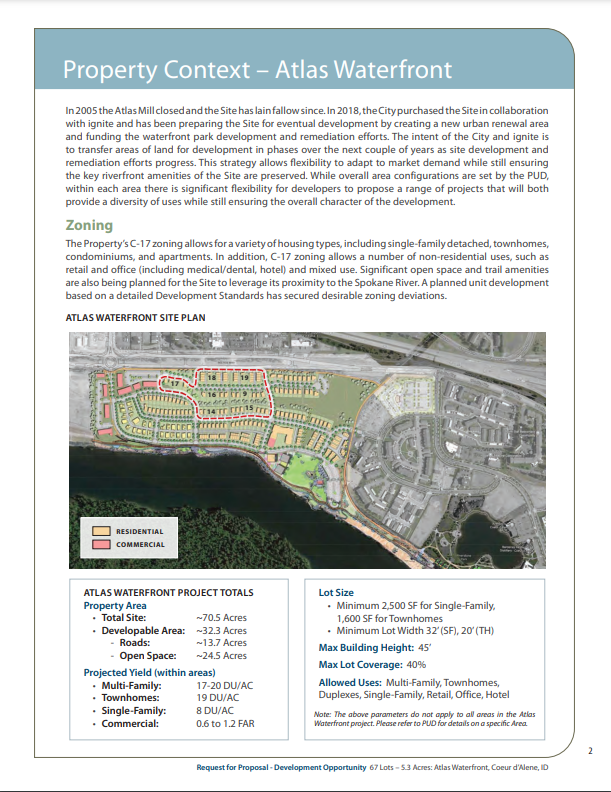

The Planning Commission approved the Planned Unit Development and Preliminary Plat for the Atlas Waterfront Project at their November 12, 2019 meeting. This includes the Atlas Waterfront Neighborhood Development Standards, which can be viewed here. All related information is available on ignite Cda’s website at this link

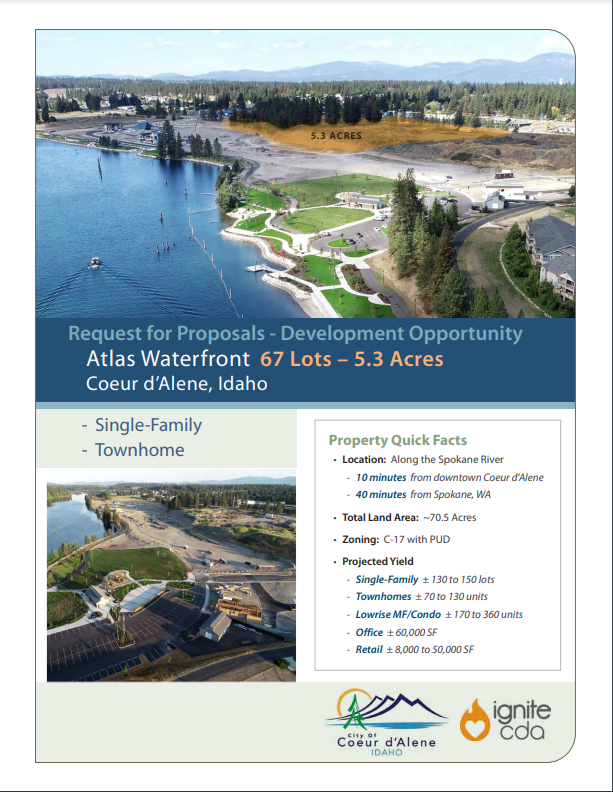

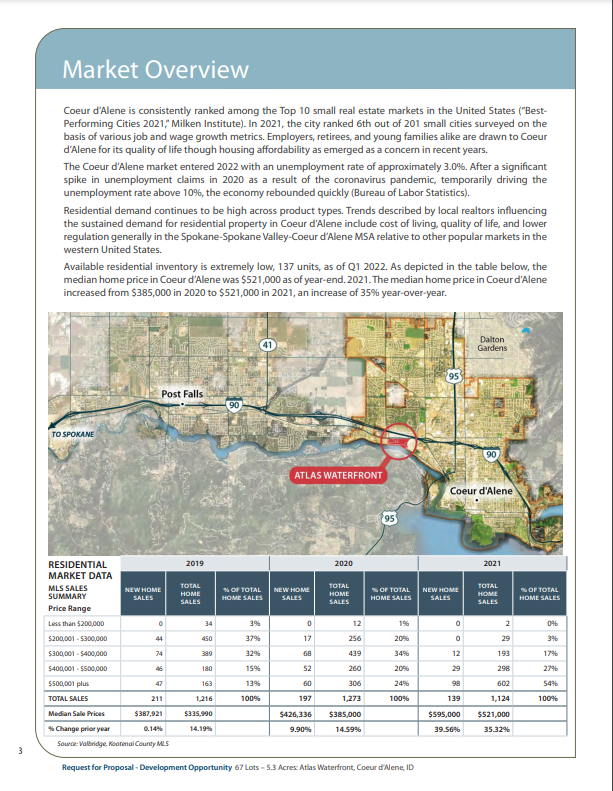

The City of Coeur d’Alene has officially purchased nearly 47 acres of Spokane River waterfront property that was the former Atlas Mill site. The City purchased the property for $7,850,000 and the sale was recorded on May 16, 2018, making the sale official. The City began the process of purchasing the Atlas Waterfront property in May of 2017. The City purchased the property to create permanent, public waterfront access and encourage economic development initiatives on the

The City of Coeur d’Alene is working in partnership with ignite CDA to assess all opportunities related to uses of this property and to engage the community. The City Council and ignite CDA board members have directed staff to move forward with creating a new urban renewal district, which is being referred to as the Atlas District, and to expand the River and Lake district

A Site Analysis, Financial Feasibility Study and Master Planning effort is underway to develop a urban renewal plan for the project. That effort is being led by Welch-Comer Engineers with sub-consultants Heartland and GGLO. City staff, ignite CDA, and elected officials have been working together to provide feedback on the analysis and to provide ample opportunities for community outreach and public involvement. Special thanks to CDA2030 and other community volunteers for making the community engagement efforts to date a success

Atlas Waterfront Project News & Information

- ATLAS WATERFRONT NEWS LOG (Click on link for more project information and news)

- COR Vision Group

- Frequently Asked Questions

- Traffic Impact Study Frequently Asked Questions

- Property Photos – Taken June 2017

- Environmental & Geotechnical Research of Property

- Resolution No. 14-049 – A City Council resolution calling for maximization of public access to riverfront property

- City Purchases Atlas Waterfront – It’s official. The 47-acre Atlas Waterfront property is now owned by the City of Coeur d’Alene! The City purchased the property for $7,850,000 and the sale was recorded on May 16th, making the sale official. The City began the process of purchasing the property in May of 2017.